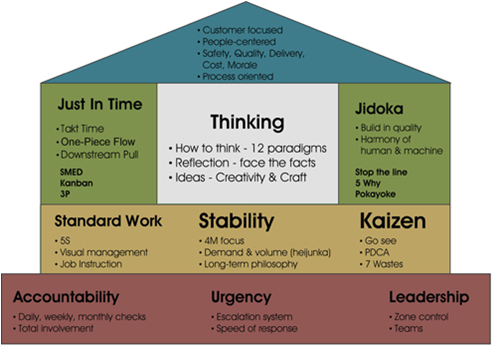

Without a doubt, Lean Manufacturing has been a transformative idea that has its genesis in the Toyota Production System Many companies have been able to reduce inventories and reduce order-to-delivery times simultaneously. There is nothing new in this statement.

What is interesting is an article in Business Week discussing how Deere & Co is struggling to satisfy customer demand because of their adoption of Lean. While undoubtedly, as stated in the Business Week article, there has been a big emphasis on Lean adoption in Deere which has led to large reductions in inventories, I think there is more that can be drawn from the story. The question is whether you can get too Lean?

Before I start though, here are some caveats: I am not a Lean practitioner, I am not a financial analyst, and I do not know the strategies of the companies I will discuss below. But I am a farm boy, and had a Massey Ferguson, one of the AGCO brands.

I spent many happy hours ploughing fields and reaping crops on “big red”. I learned to drive the tractor when I was 5 and had to pull down on the steering wheel because I wasn’t heavy enough to push the clutch down. Going to the tractor dealer was infinitely more interesting than going to the car dealership or toy store. However, I digress.

As a child I experienced the side of the buyer, and as an adult I have been inside more than one of the Ag equipment manufacturers as a consultant, so I know a little of their operations too. As the Business Week article states, this is a highly seasonable business. One thing that has changed dramatically since my father bought tractors is that they are now highly configurable with all sorts of options that include air conditioning and GPS. Combining seasonality with configurability is a toxic mix for getting Lean wrong. A central tenet of Lean is “level loading” which is all about keeping a regular cadence in production. This is fine when you can predict the demand very well, but outside of these tight boundaries, it is really easy to get into trouble either in terms of missing customer shipments (as is the case at Deere), or in terms of not making best use of capacity. From the numbers, it appears that Deere has focused on reducing inventories without implementing an adequate postponement plan to reduce the order-to-delivery cycle. Let’s go and look at the numbers.

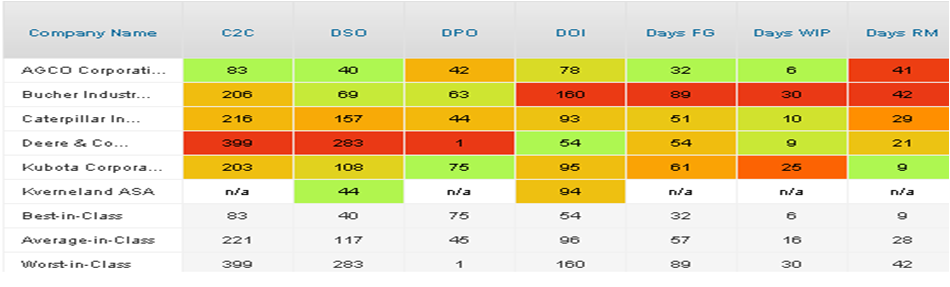

The data in the table above is based upon the 2009 financial results. (You can do the same analysis using our free benchmarking service.) From this, we can see that Deere & Co has by far the lowest days of inventory (DOI). However, look at their cash-to-cash (C2C) and days of sales outstanding (DSO). Their DSO is 7 times more than that of AGCO, which is best-in-class.

What I suspect is that the Deere DSO represents a lot of inventory sitting on dealer floors for which Deere has extended long payments terms to the dealers. I don’t know this for a fact, but from what I know of the relationships between OEM’s and dealers in the Ag Equipment industry, I suspect this is the case. More interesting from an operational perspective, is to analyze Deere’s inventories, especially in comparison with those of AGCO. We see that Deere has roughly double the finished goods (FG) inventory of AGCO and roughly half the raw material (RM) inventory of AGCO. The work-in-progress (WIP) inventories are roughly the same, though in real terms, AGCO’s are 33% lower.

The conclusion I come to is that Deere makes FG and stuffs the channel. If the FG values don’t convince you, what about the DSO? It would appear that AGCO has worked out how to forecast dependent demand – components and sub-assemblies – so they buy a bunch of stuff and then do late stage assembly to meet market demand. I come to this conclusion because they have the highest RM yet the lowest WIP and FG. Compare that to Deere which is organized the other way around with more FG and relatively little WIP and RM. My conclusion is that AGCO is the company that has truly embraced Lean. Simply reducing inventories without a good postponement strategy is a recipe for poor performance.

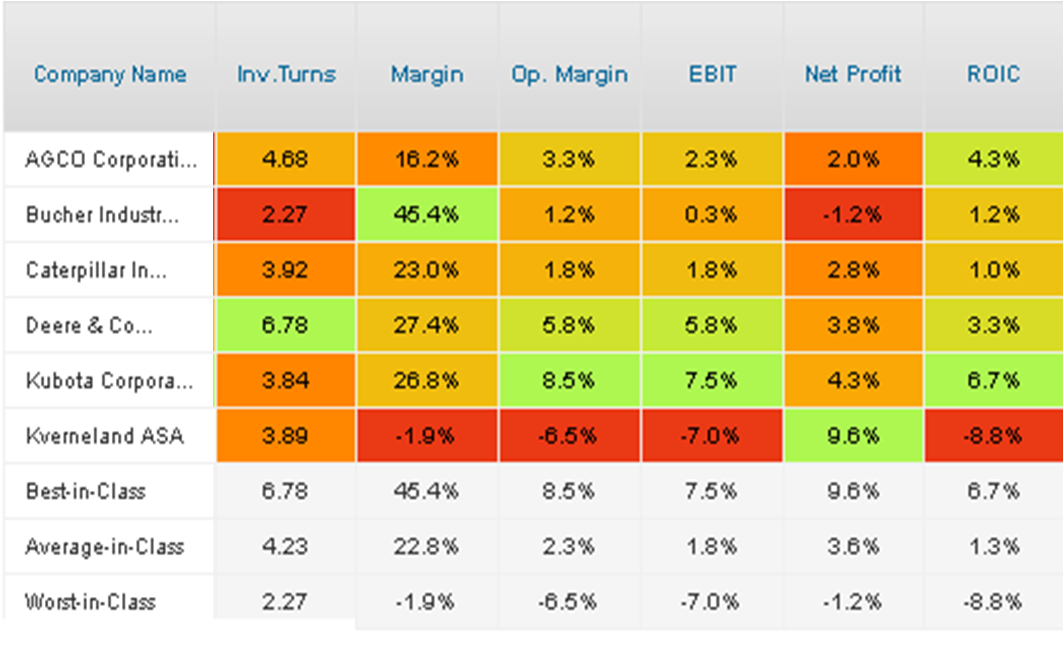

Where we see the real benefit to the AGCO investors in the return on invested capital (ROIC). Clearly there is a lot that Deere is doing that is correct. Of the big Ag Equipment companies they have the highest margin values, all the way from gross margin through to net margin. So I hope they get this right. Let me repeat at this point that none of my analysis is based upon deep knowledge of how these companies operate. I could be wildly wrong, but I don’t think I am. What do the Lean experts out there think?

Discussions

http://leanjourneytruenorth.blogspot.com/2010/04/lean-blamed-for-perils-at-john-deere.html

Tim McMahon

A Lean Journey Blog

http://leanjourneytruenorth.blogspot.com

Thanks for the comment. I read your blog and the comments. In truth I can't tell from your comment above and from your blog whether or not your agree with me. Clearly we both agree that Deere probably did not implement Lean very well. It is more on the side of the suggested solution that I an unclear whether you agree with me or not.

From what I do know about Lean, the one comment that really struck a cord was "oh, and you need very level, predictable demand". Perhaps it is just my ignorance of Lean, but several friends of mine who are Lean black belts have grudgingly admitted that Lean is severely tested in situations with high demand volatility. This is expecially true in environments with highly configurable end items, such as Ag. This is what I refer to as the "toxic mix".

Toyota has been a master at market analysis and demand shaping, all in the pursuit of "level loading". They have a relatively small product variation compared with volume, and in reality very few of their cars are configured by end customers. So undoubtedly we could argue that Deere should have done better market analysis. However I still believe that postponement will be key to Deere because of the much higher product variation compared with volume, and the fact that the customers can configure their specific tractors, all with any equipment.

Comments?

Regards

Trevor

The other very likely possibility is that there was something else that Deere did to cause their problems and it had nothing to do with Lean or load leveling, but the author from Business Week could pick up on it and wrote how it was load leveling and leans fault. it would be the first time a misunderstanding like that happened.

If McD makes too many of one type of burger they will sit on the warming shelf for ever. A customer will either have to eat an old burger or wait for a new burger, one of the one's McD did not prepare even if it a "standard". If they do not have an effective preparation process, they may be faced with the double whammy of customer's waiting too long and food that has spoiled.

In other words, it goes beyond the business model into operations, which should always be organized and incented to achieve the business model, not just the business objectives.

I my opinion you can not become too Lean, but you can become tool Lean.

That could be the case if you are just implementing lean tools without:

- top management driving it

- people involvment

- setting customers first

- understanding the capability of your system

- being able to absorb variation

So my short answer is: No

Deere for many years has been known for relatively conservative business thinking typically using relatively high inventory levels and product integrity to satisfy customers, but their lead times have also typically been some of the longest in the industry. That was OK as long as the market was willing to wait for their products and given the extremely strong reputation and brand loyalty that Deere had built up, the market place was content to live with the lead time.

As with most companies Deere misjudged this last recession in entry timing, depth and breadth and obviously went on a lean (possibly misguided) program to maintain margin and cash flow; now having not properly judged the exit from recession they have minimal inventory to fall back on to support an uptick in demand. Yes you can run too lean especially if the lean process is primarily driven by strictly financial needs and not by market demand and operating capabilities. As well Deere possibly misjudged the fact that maybe their reputation and the willingness of the market place to wait for delivery has deteriorated during the recession and some customers desperately need to go elsewhere to replace ageing equipment.

Deere for many years has been known for relatively conservative business thinking typically using relatively high inventory levels and product integrity to satisfy customers, but their lead times have also typically been some of the longest in the industry. That was OK as long as the market was willing to wait for their products and given the extremely strong reputation and brand loyalty that Deere had built up, the market place was content to live with the lead time.

As with most companies Deere misjudged this last recession in entry timing, depth and breadth and obviously went on a lean (possibly misguided) program to maintain margin and cash flow; now having not properly judged the exit from recession they have minimal inventory to fall back on to support an uptick in demand. Yes you can run too lean especially if the lean process is primarily driven by strictly financial needs and not by market demand and operating capabilities. As well Deere possibly misjudged the fact that maybe their reputation and the willingness of the market place to wait for delivery has deteriorated during the recession and some customers desperately need to go elsewhere to replace ageing equipment.

Leave a Reply