In a recent exchange with Lora Cecere on Twitter in which I stated that “agility” is a requirement for any modern supply chain, Lora challenged my statement by stating that there isn’t a standard definition for agility. More precisely, Lora’s point was that there isn’t a standard way of measuring agility, which of course relies on a standard definition. OK, I get Lora’s point, but, like that famous statement by a U.S. Supreme Court judge when asked to define pornography, he replied that “I know it when I see it.” So let us explore some of the terms, particularly agility, used to describe today’s supply chains. The many terms and definitions…are we all saying the same thing? As long ago as 2004, Hau Lee used “Agile” as one of the cornerstones of his Triple-A Supply Chains, the other two being “Adaptable” and “Aligned.” Hau’s full definition is: Agile: They respond quickly to sudden changes in supply or demand. They handle unexpected external disruptions smoothly and cost-efficiently. And they recover promptly from shocks such as natural disasters, epidemics, and computer viruses. Adaptable: They evolve over time as economic progress, political shifts, demographic trends, and technological advances reshape markets. Aligned: They align the interests of all participating firms in the supply chain with their own. As each player maximizes its own interests, it optimizes the chain’s performance as well. In a recent IndustryWeek article titled “The Dynamic Supply Chain,” Mark Pearson of Accenture makes the statement that:

… 70% of executives who responded to a recent Accenture survey expressed concern about their inability to predict future performance, and more than 80% worried about the overall resilience of their supply chains in the face of unrelenting market challenges.

This is a great summary of the market drivers that are forcing manufacturers to adopt the concepts behind dynamic supply chains. But what are these concepts? From Mark’s description of the market drivers, we now we have three terms: Dynamic, Agile, Resilient. Mark does not define these terms, although he adds other terms including Flexibility, Adaptability, and Responsiveness. Nevertheless, Mark does a great job of describing the primary characteristics of a dynamic supply chain:

- "Portfolio of supply chains"

- Dynamic operating model

- Sense, Shape and Respond

- Flexible Product Strategy

- Agile Execution

- Operational Hedging

For me, all of these terms come down to agility in the face of demand and supply volatility, the key point from the Accenture survey quoted by me above. The best definition of agility comes from Martin Christopher at the Cranfield School of Management in an article titled “The Agile Supply Chain: Competing in Volatile Markets”:

Agility is a business-wide capability that embraces organisational structures, information systems, logistics processes and, in particular, mindsets. A key characteristic of an agile organisation is flexibility. Indeed the origins of agility as a business concept lie in flexible manufacturing systems (FMS). Initially it was thought that the route to manufacturing flexibility was through automation to enable rapid change (i.e. reduced set-up times) and thus a greater responsiveness to changes in product mix or volume. Later this idea of manufacturing flexibility was extended into the wider business context (3) and the concept of agility as an organisational orientation was born. Agility should not be confused with Lean. Lean is about doing more with less. The term is often used in connection with lean manufacturing to imply a zero inventory, just-in-time approach. Paradoxically, many companies that have adopted lean manufacturing as a business practice are anything but agile in their supply chain. The car industry in many ways illustrates this conundrum. The origins of lean manufacturing can be traced to the Toyota Production System (TPS), with its focus on the reduction and elimination of waste.

What I love about this definition by Martin is the comparison and contrast between agility and lean. This contrast is brought out in a blog titled “Supply Chain Concept,” in which the author states that the difference between agile and lean supply chains is as follows:

Lean:

- Forecast at generic level

- Economic batch quantities

- Maximize efficiencies

Agile:

- Demand driven

- Localized configuration

- Maximize effectiveness

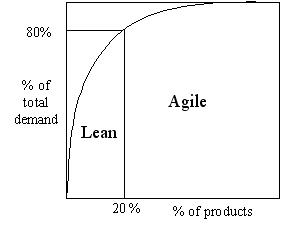

What is not stated in the diagram above is that if an equivalent diagram were drawn with margin on the Y axis, it is likely that the 20% of the products that make up 80% of the total demand would only account for 50% or less of the profit. This is because many of the products in the “agile” space have higher margin, often because they are new products.

Discussions

thank you