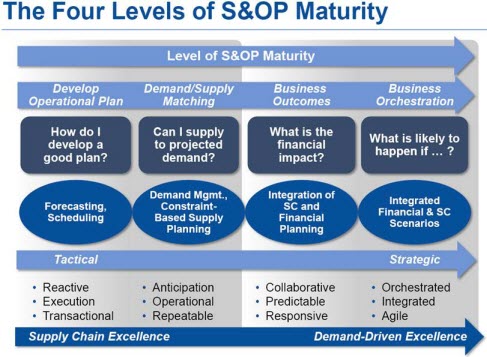

It is many years since Gartner started discussing demand-driven value networks. This concept is central to their ideas of an S&OP maturity model in which the most mature level, “Business Orchestration”, is all about what Gartner calls demand translation. The diagram below is from a Gartner webcast (Delivering Business Value from S&OP, Applebaum, T., Kohler, J., 29 March 2012). While this was presented on Mar 29, 2012, the earliest Gartner reference to demand-driven value networks dates from the early 2000’s.

In a public report Demand-Driven Value Network Orchestration Key Initiative Overview), Lord, P., 3 February 2012) Gartner defines demand translation as

Demand-driven value networks (DDVNs) integrate processes and data in the supply chain to enable collaboration, as well as orchestrate a response to demand that creates value and mitigates risk.

A broader definition of DDVN available on the Gartner website states that

A demand-driven value network is a business environment holistically designed to maximize value across the set of processes and technologies that senses and orchestrates demand based on a near-zero-latency signal across multiple networks of employees and trading partners.

In a recent report, (Definition: Demand-Driven Value Networks, Burkett, M. 13 July 2012) describes the required attributes of DDVN as

- End-to-end alignment and synchronization of demand, supply and pr noduct cycles across multiple enterprises

- Ability to better manage demand through sensing and shaping processes

- Ability to translate demand to deliver a profitable and sustainable supply response

- S&OP that links execution with strategy to facilitate conscious trade-offs across demand, supply and product networks

- Metrics driving joint value for customers, suppliers and shareholders

- Technology architecture enabling collaborative relationships, end-to-end visibility, responsiveness, and fact-based decision making to maximize value and mitigate risk

- Culture that develops and/or acquires talent to enable transformation and that encourages new learning, while also gaining scale by sharing standardized and proven practices

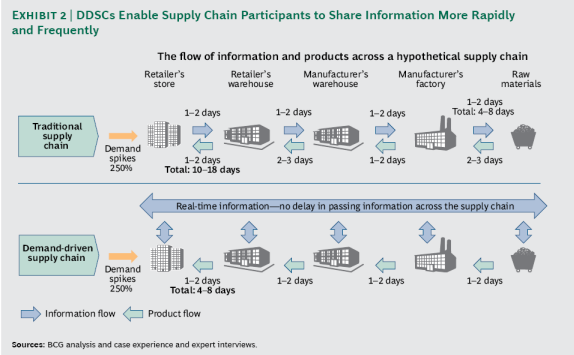

What I find fascinating is that other companies are now promoting this concept, not the least of which is Boston Consulting Group (BCG). In an article (The Demand-Driven Supply Chain: Making it Work and Delivering Results, John Budd, Claudio Krizek, and Bob Tevelson, 30 May 2012 – free registration required) they give a practical example of how DDVN can reduce the overall cycle time of responding to a demand spike.

What I find most interesting in this diagram is the manner in which they describe a different information layer that crosses organizational boundaries. In the top half of the diagram, the “traditional” supply chain we can see data flowing between systems, usually between ERPs with EDI signals, that is a cascade, starting from demand and bubbling up the supply chain to raw material. The information first has to go from the retailer’s store to the retailer’s warehouse, and then to the manufacturer’s warehouse, etc. I think we can all recognize this as the most dominant form of demand propagation in place today. The reason is that demand translation – the conversion of a demand signal into an appropriate supply signal – has to take place at each level (and node) of the supply chain before the signal can be propagated to the next node. It is difficult enough to do this with standard products at a finished goods level. Try doing this with a configurable product that is made up of 100’s of components, in an outsourced and distributed supply network. An interesting characteristic of a DDSC described by BCG is that

A DDSC requires a scalable architecture that is flexible and robust enough to dynamically incorporate changes as they arise.

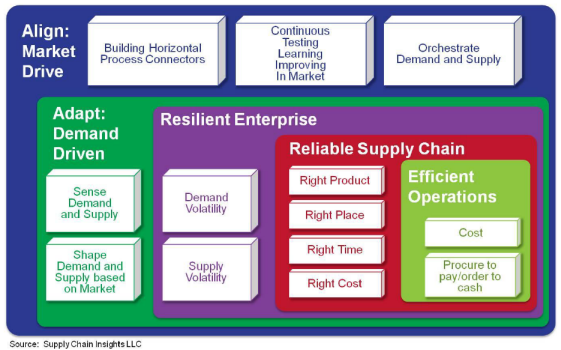

This is where the need for the “Real-Time Information” layer comes into play. Clearly this layer has to be enabled by something other than semaphore, an abacus, or Post-It notes. For far too long we have tried to enable this layer with email and Excel, a clear indication that our core transactional layer is not satisfying this need. But as I stated before, the dominant mechanism of moving data between functions and organizations is still overnight (at best) EDI between ERP systems. The use of email and Excel is merely a mechanism used to try to overcome the limitations of operating an end-to-end supply chain with cascaded EDI transfers. But even if you manage to get beyond email and excel, how do you know that the calculations performed at each level of the supply chain in the “Real-Time Information” layer are consistent with the calculations performed by the ERP at each level. It defeats the whole purpose of the “Real-Time Information” layer if at each level the MRP or planning analytics have to be invoked in the ERP system. At the very least, doing this will eliminate the real-time aspect of this layer. And yet it is necessary for this layer to translate the demand at that layer into a required supply in a manner that is consistent with the underlying ERP system. In other words a truly functional DDVN must be able to emulate the policies, bills-of-material, routings, sourcing rules, lead times, capacities, and manner other aspects of the supply chain model in order to perform the demand translation required to provide an end-to-end profitable response. In a Supply Chain Insight’s report (Building Market-driven Value Networks - Driving Differentiation in Supply Chain Processes Market-to-Market, Cecere. L, 11 July 2012) Lora Cecere uses the following diagram to describe a similar concept.

In the report Lora defines supply chain agility as the

ability to recalibrate plans in the face of market demand and supply volatility and deliver the same or comparable cost, quality, and customer service.

More interestingly Lora states that

In the adaptive supply chain, the processes first sense and then shape demand based on revenue management practices. This is sometimes termed “a demand-driven supply chain.” Demand shaping includes the active processes of new product launch, price management, trade promotion management, marketing and advertising, and incenting sales against revenue management processes. They build processes outside-in to evaluate what “really matters to customers.” Companies that mature in this capability usually are also mature in the processes of analyzing customer profitability through cost-to-serve analysis and looking at product profitability to determine the right product portfolio. They actively manage complexity.

All of these comments have described a technology layer that far transcends what some commentators and technology vendors are portraying as “control tower” solutions. These almost never go beyond simple visibility and alerting solutions. As in many situation, visibility is a precursor, but not an adequate definition. Without a doubt the descriptions used by Gartner, BCG, and SCI all go way beyond this simplistic perspective. Even if we extend visibility to alerting we are in no way even approaching the sophistication described by Gartner, BCG, and SCI. Do we know the downstream/upstream impact of the event causing the alert to be issued? Isn’t the impact what actually determines whether the event is important or not? How does one even determine to whom the alert should go when much of the supply chain is outsourced? Imagine the consequences if an airport control tower could only alert someone if a plane was in the wrong position but not tell that person that if the plane does not move in the next minute there will be a collision with a second plane. As importantly, imagine if the system couldn’t even detect, let alone alert the control tower, that the second plane was on a collision course. After all, in a purely event-based system, there is nothing to indicate an alert condition for the second plane because it is being viewed in isolation. This is what you will get from solutions that don’t incorporate all the capabilities described by Lora Cecere, Mike Burkett and others. Is this really the supply chain control tower you want? Going beyond simplistic 1990s event alerting to true risk/opportunity analysis and rapid, reasoned response is available today. This is not Star Wars or a mission to Mars, though even those idioms have lost their sense of impossibility lately. It is a journey of maturity, and as our skills, processes, and technology mature we need to both grasp the opportunity and extend the art of the possible. I’d love to hear from people where they think they are in this journey and the steps you are taking to achieve it.

Additional Resources

- Supply chain control tower frequently asked questions

Discussions

Thanks for this. There are some good insights here. However, I have a practical question. Can anyone help?

I have worked in FMCG most of my life and fully appreciate the value of S&OP. In particular, the explicit need for the first two elements (New Activities and Demand Planning). However, I am now working in a contract manufacturing environment. We issue quotes (which we may or may not win). Only once an order is won, can we commit resources to design and purchasing materials. Therefore every contract is a 'new activity'. There is no such thing as a base volume of demand, other then WIP on contracts that we have won.

Can you (or anyone else) suggest any good examples or references to the use of S&OP in this uncertain demand environment?

Martin

The reporting system can only be useful to analysis the conditions and progressive of the organization, and also i like to being the clear fact that the reports can only help us to make statistical solutions,

the true fact has to be assesed based on the report, doing this will eliminate the real-time problem and find the solution to plan supply chain, where we can put things in a manner that is consistent with the Demand

The ERP system. are DDVN will help us put the aspects of the supply chain model in order to perform the demand translation in equal ratio.

Many of our largest and oldest customers are electronics CMs such as Flextronics & Jabil. They use us to deal with this type of demand volatility.

As importantly we also have many electronics OEMs as customers in both the B2B and consumer electronics environments. They too struggle with demand volatility, especially because of rapid NPI and new technology introductions which drive both NPI and ECNs in a highly outsourced supply network. In other words the OEMs struggle with both demand and supply volatility.

This is precisely where 'demand translation' becomes so important. Often the forecast accuracy is only slightly more than 50% when measured at the SKU & customer level, the level at which accuracy matters. Being able to detect variance from plan very quickly - true demand - and translating this into a profitable supply response is what demand translation is all about.

To be fair to the likes of Gartner, SCI, and BCG, demand translation also has an aspect of demand shaping to it which is of greatest relevance to a B2C environment, but also has applicability to the B2B environment. In the CM environment we find most most focus is on profitable response to real demand given lead time, capacity, and material constraints.

Allow me to translate this into my own words in a way that offers some practical ways forward. When I was working in FMCG, the biggest cause of demand volatility was promotional activity. Forecast accuracy was appalling (we would dream of 50% !!). So instead of working to a forecast we looked for ways of reacting super fast to ACTUAL demand. (e.g, we used EPOS data (obtained daily from our customers), we reduced supplier leadtimes to hours, we had the factories on standby and we held extra stocks of raw materials)

In Contract Manufacturing, I guess exactly the same principles apply. Its all about being prepared and working closely with suppliers to ensure short leadtimes (probably measured in weeks rather then hours) and being able to start the manufacturing process asap once a quote is converted.

So simple really !!

Martin

Yes, you are correct that a lot of the responsiveness to true demand is in preparation.

I would add though that it is a lot easier to reduce the decision lead time than the physical SC lead time. Undoubtedly you need to work on both, but the speed with which you can translate true demand into a profitable response has a big impact on customer service (and ultimately revenue) and profitability. It also reduces churn in the supply chain by being able to determine the capabilities of satisfying the demand without changes to the supply picture and the disruptions that would be introduced in order to satify the demand. Rational trade-offs between customer service and profitability can be made once the constraints and constraint relief are understood.

The point being that the decision to satisfy a single order cannot be made in isolation. One must make trade-offs and often the trade-offs are simple once the facts are available. For example, certain materials may be allocated to replenishing safety stock a one DC and could be redirected to satisfy demand in a different region, but what would be the likely customer service impact at that DC over the next few weeks? The supplier has material available but the usual delivery mechanism is too slow so does it make sense to split the delivery and expedite the delivery of just some of the material, or are there a bunch of other orders that could be delivered closer to CRD if all the material is expedited?

If it takes a week to perform this analysis, heck if it takes more than a few minutes, at most an hour, no-one is going to do it because the whole SC will have changed. Besides it is just too much effort. But this sort of analysis can have a big impact on revenue, customer service, and profitability.

Know sooner, act faster, with confidence.

Regards

Trevor

I know I'm a little late joining, however, our insights into simnple software that can do this are likely to have far reaching implications on how we all use the Internet. Here's to making The Next Internet.

Leave a Reply