One of my colleagues, John Westerveld, recently wrote a blog about visibility titled “Visibility in the supply chain: What you can’t see can hurt you.” The key point John is making is that if you can’t see it you can’t manage it. There is a related issue discussed in a LinkedIn group on supply chain KPI’s, which can be loosely interpreted as “You can’t change what you don’t measure”. What I find interesting in the discussion is that there is very little mention of financial metrics.

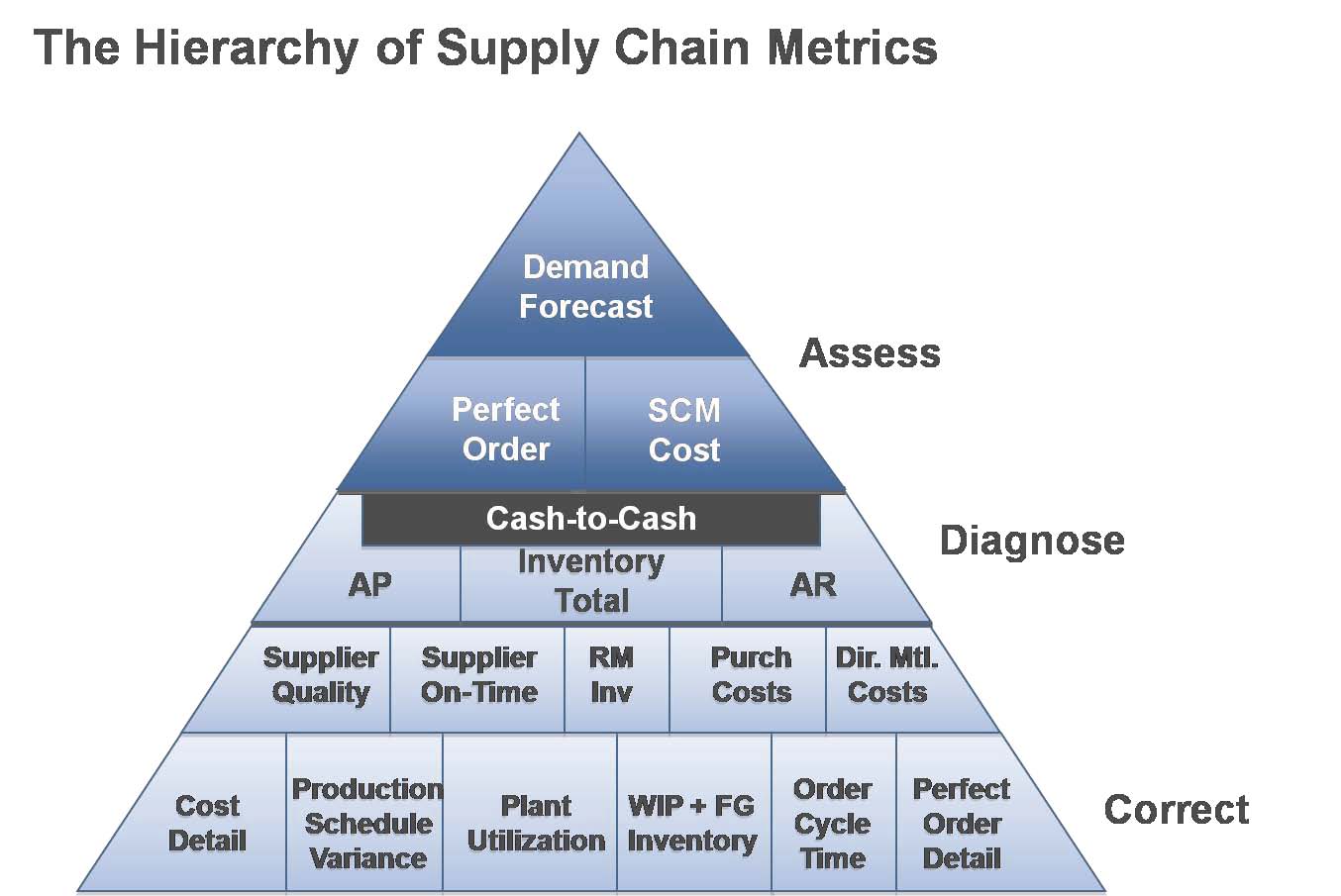

Nearly all the discussion is focussed on detailed operational metrics. In addition, there is little or no discussion of the relative importance of specific KPI’s. There is some discussion of target setting, but almost none of benchmarking. There is no point of being proud of achieving an inventory turn target if all you competitors exceed the target by a lot. At the AMR Supply Chain Executive Conference in 2008, Jane Barrett and Deborah Hoffman's presentation "Benchmarking Your Own Supply Chain" included the following slide:

What I find most interesting in the diagram is the implicit approach to using the supply chain KPI’s of Assess, Diagnose, Correct. First of all, assess if your supply chain is healthy, then find out where the problem lies, and finally correct the problem. I agree with this approach, but I would put cash-to-cash at the top of the pyramid. I can only assume that AMR placed the demand forecast at the top to promote their concept of a demand driven supply chain.

What is most interesting when comparing the AMR hierarchy with the LinkedIn discussion is that almost all of the metrics proposed in the LinkedIn discussion are at the bottom of the hierarchy, at the “Correct” stage of using the KPI’s. Clearly we supply chain need to up our game to become relevant to senior management. There can be no greater measure of a supply chain than the efficiency with which purchased raw material is converted to cash, which is why I suggest you use cash-to-cash to assess the health of your supply chain.

The usual objection I have heard regarding cash-to-cash is that much of accounts receivable and accounts payable is outside the control of the supply chain organization. This is a fair point except that the supply chain should be managed in a manner consistent with the payments terms agreed with customers and suppliers.

For example, if short payment terms have been agreed with suppliers, there should be a strong focus in the supply chain organization to reduce raw material inventories because of the associated risk of excess and obsolete inventory is increased. The company will have paid for the inventory earlier so the financial cost of holding the inventory will be greater than in companies with longer payment terms. I need to state that reducing inventory levels is always a good idea.

I am only trying to illustrate that cash-to-cash is a very good measure of the overall efficiency of the supply chain. Next on my list, at the Diagnose level, would be a number of margin calculations, starting with gross margin, though I would also include what I call SG&A margin and R&D margin, both of which are of course values included in the calculation of operating margin. These are calculated in the same way as gross margin. That is I calculate SG&A margin as (revenue – SG&A)/ revenue, and R&D margin as (revenue – R&D)/revenue.

As with cash-to-cash, many of the influences of these margin KPI’s are outside of the direct control of the supply chain organization, but they do give a lot of insight into the relative importance of building the products versus selling the products and developing the products. This comparison also allows a company to understand where they can get “the biggest bang for their bucks” by implementing change. Given that this blog is focussed on supply chain management, I would also bring in inventory measures as this level, such as inventory turns and days of raw material, work in progress and finished goods. These give you some indication of where the problem lies.

For example, I know of one company whose WIP inventory exceeds their RM and FG inventories combined by a 5:1 ratio. No prizes for guessing where I would start. Lastly these metrics only have relevance when compared and over time.

In other words, it is very important to benchmark your supply chain against your competitors to get a good understanding where your company is competitive. Understanding how you are comparing over time is a good way of understanding if your company is losing or gaining on your competition. A snapshot cannot provide this insight. And why not also benchmark your customers and suppliers?

Imagine the value of discovering that your company is a about to enter into a long term supply agreement with a customer whose gross margin has been steadily decreasing over the past 3 years. Without a doubt detailed operational metrics are important, but only in the context of where your company wants to compete and how your company compares over time to your competition. As AMR promotes, first assess your supply chain, then diagnose what are the biggest issues, before drilling to the details. As always, let me know what you think.

Discussions

I agree that the KPI's you mention - order fill rates, damage free & on-time delivery - are important. The question is where they should be slotted in the Assess/Diagnose/Correct hierarchy. I would argue that these are symptoms and therefore should be at the Correct level. The Assess level should be a combination of checking for misalignment in the organization and makign sure you are at least in the game, so benchmarking against competitors.

It is always difficult to separate out symptom and cause. Have a look at this blog I wrote about a recent story about Deere. https://blog.kinaxis.com/2010/04/can-you-get-too-lean/ The key idea is that DSO is indicating an issue with FG inventory sitting in the channel, while at the same time customers cannot get what they want. Without looking at the DSO and inventory levels we could be subscribing "blood thinners" when in fact the patient needs "exercise".

Without a doubt Deere needs to triage their order-to-delivery process in the short-term, and improvements could be measured by on-time delivery. But notice that the previous sentence is constructed - not deliberately - in terms of correcting a problem. The real issue is a mis-alignment between demand and supply which is best brought out bu analysing cash-to-cash, and drilling down from there.

I would love to hear from others our there who have different thoughts.

Please inform us the Supply chain diagnosing with neuro linguistic programming (NLP) and news regarding Supply chain manager.

Best regards

Please inform us about neuro linguistic programming (NLP) and news regarding Supply chain manager if it is possible.

thanks and Best Regards

We don't have plans to write about NLP and supply chain management anytime soon, but we'll make a note of your interest and keep it in mind as we plan future blog posts.

Thank you!

Leave a Reply